It’s one thing to be intimidated by bond market vigilantes. It’s another to be intimidated by the fear that bond market vigilantes might show up one of these days, even though you’re currently able to sell long-term bonds at an interest rate of less than 3.5%.Since I wrote that post, by the way, the long-term interest rate has dropped to 3.12%.

Yet that, according to rumors, is what’s happening.

But even stranger, in a way, is the power of invisible bond market friends, who will reward you if you just scourge yourself hard enough. Consider this article in Reuters, which tells us that

A market backlash against countries seen to be dragging their feet on cutting debt and deficits has sparked budget cutbacks all over Europe as governments try to rein in spending.This seems to imply that countries that haven’t dragged their feet have been rewarded, right? And this is often reported as something that has, in fact, happened — because it’s what’s supposed to happen.

But the rewards to austerity remain, well, invisible. Ireland’s risk spreads are worse than Spain’s, even though Ireland wasted no time on self-flagellation while Spain hesitated. Market confidence in Greece has declined since the government accepted the IMF austerity plan.

Strange: it’s as if bond markets don’t believe that short-term pain that doesn’t improve your long-run budget prospects, but does lead to depression and deflation, makes you a safe bet. But I’ve got an invisible 6-foot rabbit over here who says they’re wrong. Hello, Mr. Smith.

Invisible bond vigilantes

Back in 1993, James Carville — frustrated over the way fear of rising interest rates was crimping the Clinton agenda — declared,

Alas, I’m getting the sense that the Obama administration is intimidated all the same. We’ve got the president telling Fox News that he’s worried about a double-dip recession if he doesn’t reduce the deficit soon — as opposed to the concern I and other have that he’ll have a double dip if he doesn’t provide more support. (And why is Obama talking to Fox News, btw?) And the buzz is that admin economic officials are telling him that the bond market needs to be appeased, even though rates are low.

This is truly amazing. It’s one thing to be intimidated by bond market vigilantes. It’s another to be intimidated by the fear that bond market vigilantes might show up one of these days, even though you’re currently able to sell long-term bonds at an interest rate of less than 3.5%.

Yet that, according to rumors, is what’s happening.

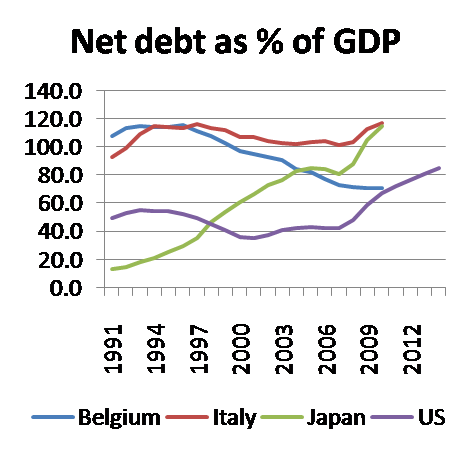

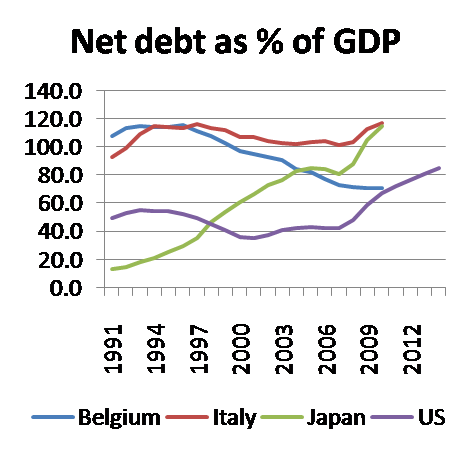

Let’s hope the rumors are false. For we really need to be doing more about employment — and the debt outlook isn’t that dire, at least by comparison with past experience in advanced countries:

OECD, IMF It would be a very, very bad thing if the administration is intimidated into passivity in the face of an employment disaster — or, worse, into neo-Hooverism — by the threat from invisible, and probably imaginary, enforcers.

OECD, IMF It would be a very, very bad thing if the administration is intimidated into passivity in the face of an employment disaster — or, worse, into neo-Hooverism — by the threat from invisible, and probably imaginary, enforcers.

I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.Right now, however, the bond market seems notably unworried by deficits. Long-term interest rates are low; inflation expectations are contained (too well contained, actually, since higher expected inflation would be helpful). No problem, right?

Alas, I’m getting the sense that the Obama administration is intimidated all the same. We’ve got the president telling Fox News that he’s worried about a double-dip recession if he doesn’t reduce the deficit soon — as opposed to the concern I and other have that he’ll have a double dip if he doesn’t provide more support. (And why is Obama talking to Fox News, btw?) And the buzz is that admin economic officials are telling him that the bond market needs to be appeased, even though rates are low.

This is truly amazing. It’s one thing to be intimidated by bond market vigilantes. It’s another to be intimidated by the fear that bond market vigilantes might show up one of these days, even though you’re currently able to sell long-term bonds at an interest rate of less than 3.5%.

Yet that, according to rumors, is what’s happening.

Let’s hope the rumors are false. For we really need to be doing more about employment — and the debt outlook isn’t that dire, at least by comparison with past experience in advanced countries:

OECD, IMF

OECD, IMF

No comments:

Post a Comment