Tuesday, January 31, 2012

THE GENERAL ASSEMBLY OF PENNSYLVANIA

| ||||||||

THE GENERAL ASSEMBLY OF PENNSYLVANIA

| ||||||||

HOUSE RESOLUTION

| ||||||||

| ||||||||

INTRODUCED

BY SACCONE, DENLINGER, STERN, AUMENT, BAKER, BLOOM, BROOKS, ELLIS,

EMRICK, FLECK, GILLEN, GROVE, HAHN, HENNESSEY, HESS, KAUFFMAN,

F. KELLER, KILLION, KRIEGER, MAHONEY, MAJOR, MALONEY, MARSHALL, MILLARD,

MUSTIO, OBERLANDER, PAYNE, PAYTON, RAPP, READSHAW, REESE, ROCK,

SIMMONS, SONNEY, STEVENSON, SWANGER AND TALLMAN, JANUARY 23, 2012

| ||||||||

INTRODUCED AS NONCONTROVERSIAL RESOLUTION UNDER RULE 35, JANUARY 23, 2012

| ||||||||

A RESOLUTION

| ||||||||

1

| ||||||||

2

| ||||||||

3

| ||||||||

4

| ||||||||

5

| ||||||||

6

| ||||||||

7

| ||||||||

8

| ||||||||

9

| ||||||||

10

| ||||||||

11

| ||||||||

12

| ||||||||

13

| ||||||||

14

| ||||||||

15

| ||||||||

| ||||||||

1

| ||||||||

2

| ||||||||

3

| ||||||||

4

| ||||||||

5

| ||||||||

6

| ||||||||

7

| ||||||||

8

| ||||||||

9

| ||||||||

10

| ||||||||

11

| ||||||||

12

| ||||||||

13

| ||||||||

| ||||||||

PA House of Representatives declare 2012 to be "Year of the Bible"

Scranton Atheism Examiner

Members of the Pennsylvania House of Representatives have unanimously approved House Resolution No. 535, a "noncontroversial resolution," “[d]eclaring 2012 as the “Year of the Bible” in Pennsylvania. WHEREAS, The Bible, the word of God, has made a unique contribution in shaping the United States as a distinctive and blessed nation and people.”

The resolution refers to the Bible as “holy scriptures” that “led to the early settlement of our country,” credits “Biblical teachings” for inspiring “concepts of civil government that are contained in our Declaration of Independence and the Constitution of the United States,” and notes that “[t]he history of our country clearly illustrates the value of voluntarily applying the teachings of the scriptures in the lives of individuals, families and societies.”

Unlike some other resolutions or legislation which may appear to some as potentially problematic, this resolution does not mince words; the text of this resolution calls the Bible “the word of God” and “holy scriptures” in addition to other problems. One should wager that if Pennsylvania lawmakers were to pass a resolution calling 2012 “The Year of the Koran” noting that the Koran was 'holy scripture' that was the word of Allah, such a resolution would be problematic. Why not, then, concerning the Bible? Governmental entities ought to remain neutral on matters of religion.

Patrick Elliott, staff attorney with the Freedom From Religion Foundation, commenting for this article, notes,

It is shocking that House leadership would classify this as a "noncontroversial resolution" and put it to a vote. It is even more astounding that representatives would pass this. It seems that either they did not know what they were voting on or they were intentionally interfering with the rights of conscience of their constituents in violation of the U.S. Constitution. This is a blatant violation. The resolution proclaims that the Bible is the "word of God," states that "renewing our knowledge of and faith in God through holy scripture can strengthen us as a nation and a people," and declares 2012 as the "Year of the Bible" in recognition of "our national need to study and apply the teachings of the holy scriptures.

Once the government enters into the religion business, conferring endorsement and preference for some religions over others, it strikes a blow at religious liberty, forcing taxpayers of all faiths and of no religion to support a particular religious view.

Suggested by the author:

NEW

YORK, NY - DECEMBER 21: A Bible is viewed during a service at Judson

Memorial Church on National Homeless Persons Memorial Day on December

21, 2011 in New York City.

Credits:

Spencer Platt/Getty Images

Pennsylvania House Declares 2012 "Year of the Bible"

Submitted by AUSCS on Jan 29, 2012

By Joseph L. Conn

Is the Bible the “word of God”? Pennsylvania House members apparently think so. They just passed a measure declaring exactly that.

Earlier this week, the House of Representatives approved H.R. 535, a resolution designating 2012 the “Year of the Bible.” Introduced by Rep. Rick Saccone (R–Elizabeth Township) and 36 other legislators, the measure insists that “biblical teachings inspired concepts of civil government that are contained in our Declaration of Independence and the Constitution of the United States.”

It also asserts that “renewing our knowledge of and faith in God through holy scripture can strengthen us as a nation and a people” and declares “our national need to study and apply the teachings of the holy scriptures.”

The resolution was dubbed “noncontroversial” so it could be brought to the House floor quickly and without committee hearings. It passed unanimously.

The measure is nonbinding, so it didn’t get much press attention. The only news account I saw was in the Examiner, an online publication.

Scranton Atheism Examiner columnist Justin Vacula questioned the constitutionality of the resolution and wondered what the reaction might be if the wording were a little different.

“One should wager that if Pennsylvania lawmakers were to pass a resolution calling 2012 ‘The Year of the Koran,’ noting that the Koran was 'holy scripture' that was the word of Allah, such a resolution would be problematic. Why not, then, concerning the Bible?

“Governmental entities,” he concluded, “ought to remain neutral on matters of religion.”

Vacula is exactly right. If church-state separation means anything at all, it ought to stand for the proposition that government stays out of religious debate. Lots of Americans believe in the Bible, but lots of others don’t. The Pennsylvania House has no constitutional authority to jump into a theological fray.

One of the great ironies of this situation is that Pennsylvania was founded as a refuge for those seeking religious tolerance. In his “holy experiment,” William Penn famously welcomed religious dissenters of many different stripes to his colony. He thought God, not government, was the “only Lord of Conscience.”

It’s a shame that today the Pennsylvania House has turned its back on that admirable tradition and sent a message of intolerance to those who do not share the majority faith.

Is the Bible the “word of God”? Pennsylvania House members apparently think so. They just passed a measure declaring exactly that.

Earlier this week, the House of Representatives approved H.R. 535, a resolution designating 2012 the “Year of the Bible.” Introduced by Rep. Rick Saccone (R–Elizabeth Township) and 36 other legislators, the measure insists that “biblical teachings inspired concepts of civil government that are contained in our Declaration of Independence and the Constitution of the United States.”

It also asserts that “renewing our knowledge of and faith in God through holy scripture can strengthen us as a nation and a people” and declares “our national need to study and apply the teachings of the holy scriptures.”

The resolution was dubbed “noncontroversial” so it could be brought to the House floor quickly and without committee hearings. It passed unanimously.

The measure is nonbinding, so it didn’t get much press attention. The only news account I saw was in the Examiner, an online publication.

Scranton Atheism Examiner columnist Justin Vacula questioned the constitutionality of the resolution and wondered what the reaction might be if the wording were a little different.

“One should wager that if Pennsylvania lawmakers were to pass a resolution calling 2012 ‘The Year of the Koran,’ noting that the Koran was 'holy scripture' that was the word of Allah, such a resolution would be problematic. Why not, then, concerning the Bible?

“Governmental entities,” he concluded, “ought to remain neutral on matters of religion.”

Vacula is exactly right. If church-state separation means anything at all, it ought to stand for the proposition that government stays out of religious debate. Lots of Americans believe in the Bible, but lots of others don’t. The Pennsylvania House has no constitutional authority to jump into a theological fray.

One of the great ironies of this situation is that Pennsylvania was founded as a refuge for those seeking religious tolerance. In his “holy experiment,” William Penn famously welcomed religious dissenters of many different stripes to his colony. He thought God, not government, was the “only Lord of Conscience.”

It’s a shame that today the Pennsylvania House has turned its back on that admirable tradition and sent a message of intolerance to those who do not share the majority faith.

Video: Rep. Allen West Tells Obama and Democrats to "Get the Hell Out of the United States of America”

Share This Story

Submitted by Michael Allen on Jan 29, 2012

Rep. Allen West (R-FL) went on an angry rant on Saturday night at the Palm Beach County GOP’s Lincoln Day Dinner (video below).Rep. West stated: “We need to let President Obama, Harry Reid, Nancy Pelosi, and my dear friend the chairman of the Democrat National Committee (Rep. Debbie Wasserman Schultz), we need to let them know that Florida ain’t on the table."

“Take your message of equality of achievement, take your message of economic dependency, take your message of enslaving the entrepreneurial will and spirit of the American people somewhere else. You can take it to Europe, you can take it to the bottom of the sea, you can take it to the North Pole, but get the hell out of the United States of America.”

Allen West Backtracks After Telling Democratic Leaders To 'Get The Hell Out' Of The U.S.

The Huffington Post | Luke Johnson Posted: 1/31/12 11:12 AM ET

Rep. Allen West (R-Fla.) is backing away from comments he made over the weekend telling Democratic leaders to "get the hell out of the United States of America."

"I don't get it. I mean, I don't understand what you're saying, you’re telling Obama and Harry Reid and Nancy Pelosi to get out of the United States? Explain that." asked Soledad O'Brien Tuesday morning on CNN.

"No, Soledad, Soledad absolutely not. And you know that," said West. O'Brien interrupted him, saying that she didn't understand what he was saying.

"Well the thing is you should've listened to the entire speech," said West. "You didn't listen to the entire speech which talked about the contrast between the quality of opportunity which allowed a young man born in 1961 in the inner city of Atlanta, Georgia to now represent the highest-income zip code in the entire United States of America. That’s the America that I love, that’s the America that's dear to me."

(Video above via Mediaite.)

West invited O'Brien to read the Federalist papers and the Constitution with him. O'Brien declined.

Over the weekend, West said at a Lincoln Day Dinner for the Palm Beach County GOP, "We need to let President Obama, Harry Reid, Nancy Pelosi, and my dear friend the chairman of the Democrat National Committee, we need to let them know that Florida ain't on the table." He added, "Take your message of equality of achievement, take your message of economic dependency, take your message of enslaving the entrepreneurial will and spirit of the American people somewhere else. You can take it to Europe, you can take it to the bottom of the sea, you can take it to the North Pole, but get the hell out of the United States of America."

After cheers, West added, "Yeah I said 'hell.'"

Bob Beckel on Fox News' "The Five" said Monday, "In my 30 years of politics, I have never heard anything more disgraceful in my life. I think Allen West owes an apology to a lot of people." West responded Tuesday on "Fox and Friends" by saying he thought Beckel owed him an apology.

The Florida congressman could face a difficult re-election in 2012, as his swing district could become more Democratic under a redistricting plan approved by a state House panel. West, however, has had strong fundraising -- he raised $1.75 million during the forth quarter of 2011, leaving him with $2.7 million in cash on hand.

Who's behind that outbreak? Sometimes, CDC won't say

Salmonella strain that sickened 109 people, including a man who died, was initially identified only as "strain X" by the CDC.

By JoNel Aleccia

When government health officials wrapped up a three-month investigation of a salmonella Enteritidis outbreak

that sickened 68 people in 10 states, the final report on Jan. 19

included nearly every detail -- except the name of the place that sold

the food.

The Centers for Disease Control and

Prevention has refused to identify the source, other than as “Restaurant

Chain A,” a Mexican-style fast-food chain.

That’s

the second time in a little more than a year that the agency has masked

the source of foodborne illness at a similar chain. In August 2010, a final CDC report found

that 155 people in 21 states were sickened by two rare strains of

salmonella traced to an anonymous Mexican-style fast-food chain

eventually identified as Taco Bell.

Two other recent outbreaks with initially hidden sources -- laboratory-supplied salmonella Typhimuirium identified only as “strain X,” and an outbreak of E. coli O157:H7

in romaine lettuce from “grocery store Chain A” -- have spurred new

scrutiny of the agency’s willingness to keep the entities behind

some infectious outbreaks secret.

Food safety advocates say the practice keeps the public in the dark about which firms have been linked to illness.

“It

will eventually come out and it will be the company that looks bad,”

said Doug Powell, a professor of food safety at Kansas State University

and author of a food safety blog.

“A lot of these problems could be reduced if government agencies were

more transparent about how they decide when to go public.”

Dr. Robert Tauxe, a top CDC official, defended the

agency’s practice of withholding company identities, which he said aims

to protect not only public health, but also the bottom line of

businesses that could be hurt by bad publicity. The CDC, the Food and

Drug Administration and state health departments often identify

companies responsible for outbreaks, but sometimes do not.

“The

longstanding policy is we publicly identify a company only when people

can use that information to take specific action to protect their

health,” said Tauxe, the CDC’s deputy director of the Division of

Foodborne, Waterborne and Environmental Diseases.

“On

the other hand, if there’s not an important public health reason to use

the name publicly, CDC doesn’t use the name publicly.”

Because companies supply vital information about outbreaks voluntarily, CDC seeks to preserve cordial relationships.

“We don’t want to compromise that cooperation we’ll need,” Tauxe said.

But

critics such as Bill Marler, a Seattle food safety lawyer, say that the

government owes the public early and full disclosure during illness

outbreaks.

“In today’s society, where transparency is so important

for decision-making, I just don’t think government has the right to

withhold that information from the public,” said Marler, who has pushed

hard for the CDC to identify the firm behind the latest outbreak.

He all but outed Taco Bell in a blog post late Monday that chronicled in which states with illnesses certain Mexican fast-food chains operate.

If

Taco Bell were indeed the entity involved in the latest outbreak, the

information would allow consumers to decide whether they wanted to

continue eating at a fast-food chain implicated in similar outbreaks in

2006 and 2010, Marler said.

In 2010, the CDC withheld

the identity of the Mexican-style “Restaurant Chain A.” But when the

name was released in error to media outlets, the CDC confirmed it, said

Lola Russell, an agency spokeswoman.

The agency has

not confirmed that the “Restaurant Chain A” in the 2010 outbreak is the

same as in the 2011 incident, and they will not comment on whether it’s

Taco Bell, Russell said.

Officials with two

other Mexican-style fast-food restaurant chains with sites in the

affected states, Qdoba and Chipotle Mexican Grill, told msnbc.com they

were not questioned in connection with the outbreak.

Taco Bell officials did not return calls or e-mails from msnbc.com seeking comment.

In the case of the outbreak of commercially produced salmonella Typhimurium that sickened 109

people between August 2010 and June 2011, including one man who died,

the CDC withheld the specific strain that caused the illnesses. The

victims of "strain X" were mostly clinical and teaching microbiology lab

students and their families, but they could have spread the germs to

the general public on contaminated lab coats and cells phones,

investigators suggested. It was those lapses in lab practice, not the

particular strain of bacteria, that caused most concern, officials said.

“In that case, we don’t think that one salmonella is a

lot different from another salmonella,” Tauxe said. “The concern is not

the strain, it’s what are the safety procedures and practices they use

in the laboratory.”

The trouble, say food safety

advocates, is that it’s not clear when or why CDC officials decide to

withhold the identity of firms involved in outbreaks and when they

decide to go public.

"No one is happy, and that's

largely because there are no guidelines people can at least point to,

whether they agree with the guidance or no," Powell said.

Tauxe acknowledged there’s no written policy or checklist that governs that decision, only decades of precedent.

“It’s

a case-by-case thing and all the way back, as far as people can

remember, there’s discussions of ‘hotel X’ or ‘cruise ship Y,” he said.

That just doesn’t pass muster, said Marler and other critics.

“If

the CDC has a good, rational reason for doing what they’re doing,

fine,” he said. “Then write it down and hold it up for people like you

and I to scrutinize.”

Related stories:

Komen cancer charity halts grants to Planned Parenthood

End to partnership has led to a bitter rift between two key women's organizations

By DAVID CRARY

updated

1 hour 51 minutes ago

NEW YORK — The

nation's leading breast-cancer charity, Susan G. Komen for the Cure, is

halting its financial partnerships with numerous Planned Parenthood

affiliates.

The result is a bitter rift, linked to the national abortion debate,

between two iconic organizations that have assisted millions of women.Planned

The Komen grants, which totaled about $680,000 last year and $580,000 in 2010, went to at least 19 Planned Parenthood affiliates for breast-cancer screening and related services. Planned Parenthood hopes to raise new funds to fill the gap.

Romney defends negative tone of Florida campaign

Joe Raedle / Getty Images

Republican presidential candidate and former Massachusetts Gov. Mitt Romney speaks with the media after a visit to his campaign headquarters on January 31, 2012 in Tampa, Florida. Romney has a double-digit lead going into the Florida primary today.

By NBC's Garrett Haake

TAMPA, FL -- Mitt Romney on Tuesday defended the increasingly negative tenor of the GOP primary campaign, telling reporters that he would not "stand back" as other candidates attacked him.

"It would be wonderful if campaigns were all nothing but positive, but that's certainly not the reality," Romney said at a press availability outside his headquarters here. "President Obama will have a billion dollars or so to attack me. He's already begun. The AFL-CIO I understand spent about a million dollars in Florida attacking me. So there are going to be attacks, and the right thing to do will be to respond to them aggressively, clear up those things that have been said that are incorrect, and point out the weaknesses-- the differences between yourself and those that you're running against."

Romney also defended his own negative attack ads and rhetoric targeting former House Speaker Newt Gingrich with the political equivalent of the playground "he started it."

"You know, in South Carolina, we were vastly outspent with negative ads attacking me and we stood back and spoke about President Obama and suffered the consequence of that and also some good debates by speaker Gingrich. We came to Florida and Speaker Gingrich didn’t have two good debates. I did. and we responded to the attacks that were coming to us," Romney said.

That would seem to be a bizarre claim at first glance, given the Romney campaign's status as the richest of all the candidates. The campaign has spent millions throughout the campaign, as has Restore OUr Future, a pro-Romney super PAC. NBC News and ad-tracking firm Smart Media Group Delta, which tracks ad spending by political candidates, reported that Romney and Restore our Future outspent Gingrich and his Super PAC by more than $2 million dollars in South Carolina.

The Romney campaign explained the governor meant they were outspent versus all the other candidates' combined spending.

"I’ll tell you if you’re attacked I’m not going to just sit back I’m going to fight back and fight back hard. I did note that in the Suffolk University poll they asked the people in Florida who has run the most negative campaign in Florida and they said Newt Gingrich," Romney said, referencing a poll which showed 37% of Floridians felt Gingrich ran the most negative campaign, compared to Romney's 31 percent. "He really can’t whine about negative campaigning when he launched a very negative campaign in South Carolina and when the people here in Florida looked at the different campaigns and concluded his was the most negative."

Romney certainly has fought back -- over the airwaves, on the stump and with his surrogates.

Romney's campaign and Restore our Future outspent Gingrich and his allied Super PAC Winning our Future on advertising by nearly a 4-1 margin here, with team Romney spending $15.9 million to team Gingrich's $4 million. Romney also spent the better part of the last two days opening every campaign event by attacking Gingrich, and several of his congressional endorsers have shadowed the former speaker's campaign events, where they've occasionally clashed with Gingrich staffers in what Romney advisers refer to as a "truth squad" operation.

With a spate of recent polls showing Romney expected to coast to victory here tonight, he conceded today he will soon need to pivot his focus back to President Obama, but also left no doubt he'd be keeping up the pressure on Gingrich going forward.

"I would like to spend more of our time focusing on President Obama. That's ultimately what's going to be essential to taking back the White House," Romney said. "But I'm not going to stand back and allow another candidate to define me. [Gingrich's] comments most recently attacking me have been really quite sad and I think painfully revealing about the speaker and what he's willing to say and do to try to take the nomination. So I just can't stand back and let him say those things about me without responding."

Not 'Desperate' for cash: Obama lists his big fundraisers

By Michael Isikoff, NBC Newswith reporting by NBC's Azriel Relph and Lisa Riordan Seville

The Obama campaign on Tuesday released an updated list of 445 major "bundlers" of campaign contributions, including a "Desperate Housewives" star, a Silicon Valley mogul, and a former Energy Department advisor who pushed a government loan for the now bankrupt Solyndra solar company.

The report provides new evidence of just how important big money bundlers are in presidential campaigns. In all, the 445 bundlers raised $74 million to $100 million for the Obama re-election campaign, the campaign reported, according to totals calculated by NBC from the rough ranges the campaign reported for each person's collections. Just 61 elite fundraisers among that group brought in at least $30 million, or at least $500,000 apiece.

Among the newly named bundlers who have raised at least $500,000 or more for the Obama re-election are

Marc Benioff, a Silicon Valley computer tycoon who founded Salesforce.com and hosted a fundraiser for the president at his home last spring;

Jack Rosen, a prominent New York real estate developer who is chairman of the American Jewish Congress; and

Kawana Brown, the chief operating officer of Magic Johnson Enterprises.

Altogether there are 88 newly disclosed bundlers for the president's campaign. Those raising $200,000 to $500,000 include

Eva Longoria, the Desperate Housewives actress;

Stewart Bainum, chairman of Manor Care and Choice Hotels International;

Joel Cantor, owner of Cantor Partners real estate firm; and

Mai Lassiter, wife of film producer James Lassiter.

The Obama list of $500,000 bundlers includes some notable names that have previously been disclosed, such as Hollywood moguls

Jeffrey Katzenberg (who has also donated $2 million to an Obama superpac), film producer

Harvey Weinstein, and

Robert Wolf, UBS Americas chairman.

- One of the president’s top bundlers, former New Jersey governor Jon Corzine, recently caused embarrassment for the campaign when his investment firm, MF Global, filed for bankruptcy, triggering an FBI investigation into whether its clients’ money had been mishandled. The Obama campaign and the Democratic National Committee last month returned over $70,000 of funds donated by Corzine and his wife.

- Another name previously disclosed is a former Energy Dept. adviser, Steve Spinner, of Menlo Park, Calif., who pushed the controversial funding of the Solyndra energy company. Emails uncovered by a Congressional committee last fall showed that Spinner, while on an Energey Department board, repeatedly pushed officials to finalize a loan for Solyndra before Vice President Joe Biden visited the company in September 2009. "What is he waiting for?" Spinner wrote to a DOE official. I have the OVP [Office of the Vice President] and WH [White House] breathing down my neck on this."

Other names on the list include:

- David Cohen, the executive vice president of Comcast, the cable firm that owns NBC and is co-owner of msnbc.com

- Anna Wintour, editor in chief of Vogue

- Laura Ricketts, co-owner of the Chicago Cubs

- Jon Corzine, former governor of New Jersey and former chairman of bankrupt MF Global Holdings

- Thomas Carnahan, founder of wind farm company Wind Capital Group

- Andrew Tobias, Miami, financial writer

- Crystal Nix-Hines, lawyer and Hollywood writer

- Mark Gallogly, private equity investor and member of the President's Economic Recovery Advisory Board

In an official filing with the FEC, the campaign's fundraising arm, Obama for America, reported having $82 million cash on hand at year end. It raised $40 million in the last quarter. A related campaign arm, Obama Victory Fund, reported raising $24 million in the last quarter, finishing the year with $1 million on hand. The Obama Victory Fund, controlled by the campaign, jointly contributes to the Obama campaign and the Democratic National Committee.

Overall, 61 Obama fundraisers are now in the highest bundler category, "$500,000 plus," 20 more than were on the previous list of 41 listed last fall.

The Obama campaign is so far the only presidential campaign to voluntarily disclose its bundlers, fundraisers who are key to a presidential campaign’s success because they collect checks en masse from multiple donors, giving them far more clout than individual contributors who are still limited to giving $2,500 a piece. Although John McCain and Obama both disclosed their bundlers in 2008, so far the Romney and other GOP campaigns have declined to release their lists.

President Obama, as a United States senator, proposed legislation in 2007 that would have required disclosure of supporters who raised $50,000 or more. That legislation was not enacted, but Obama voluntarily released names during his campaign and during his term in office.

America is becoming a nation of renters

By John Schoen

There was fresh data from the government Tuesday showing that the American dream of owning a home is fading fast.

The share of all U.S. privately-owned houses that stood empty fell in the fourth quarter to its lowest since 2006 as the number of houses occupied by renters rose faster than the pace of new vacancies created by homeowners moved out, according to the Commerce Department. There number of housing units occupied by renters rose by 749,000 in the fourth quarter compared to a year earlier; some 91,000 fewer homes were occupied by owners, the data show.

With the fast pace of foreclosures showing no sign of letting up, the U.S. homeownership rate continues to fall. Just 66.0 percent of U.S. homes were occupied by their owners in the fourth quarter of last year – half-a-percentage-point lower than a year earlier. That’s the lowest level of homeownership since the second quarter 1998.

The steady rise in demand for rentals has tightened the supply of housing, helping to push rents higher. Homebuilders report that the market for multi-family units has been a lone bright spot in the overall housing market. While the pace of new household formations has lagged historical averages, those new households are becoming renters. That trend is likely to continue until would-be home buyers gain more confidence that the housing market has bottomed, according to NAHB Chief Economist David Crowe.

Despite the ongoing high rate of default and foreclosure, the share of houses that stood empty fell in the last three months of last year. Part of the reason may be that bankers have been trying to match the pace of new foreclosures to the sale of homes they’ve already seized, waiting to sell a house before closing out the foreclosure of another one. By letting homeowners remain, banks can reduce the cost of maintaining a house until they’re ready to put it on the market.

Though the overall share of houses that stood empty fell slightly at the end of last year, it remains high by historical standards. A separate report by the Government Accountability Office in November, based on Census data, found that the number of vacant, non-seasonal, residential properties increased 51 percent nationally, from nearly 7 million in 2000 to 10 million in April 2010.

The homeownership rate will likely continue to fall until the pace of foreclosures begins to ease. So far, public and private efforts to modify loans to allow homeowners to stay put haven’t kept up with new defaults. With home buying demand weak, those newly-vacated homes will continue to weigh on home prices.

By the end of the third quarter of last year, some 12.6 percent of homeowners with mortgages – or more than 6 million homeowners - were either delinquent on their payments or in foreclosure, according to the Mortgage Bankers Association. Roughly 22 percent of residential properties with mortgages were underwater at the end of the third quarter, according to CoreLogic.

“Add to this the currently high unemployment and underemployment rates, one gets a recipe for further price declines,” said Patrick Newport, an economist at IHS Global Insight. “Our view is that foreclosures, excess supply, and weak demand will drive prices down another 5 to 10 percent.”

Our Constitutional Amendment: Get Money Out of Politics

August 19, 2011

Sign our petition to Get Money Out of Politics at www.GetMoneyOut.com

It’s time to get things done and finally get money out of politics. Our Washington insider Jimmy Williams is now preparing a Constitutional amendment to get big money from special interests out of our political system. We all know that they buy access and influence through campaign contributions, and benefit from the big payoffs (examples: Wall Street, health care, banking) and, of course, provide a lucrative revolving door to soften the blow when elected officials leave office.

It’s time to get things done and finally get money out of politics. Our Washington insider Jimmy Williams is now preparing a Constitutional amendment to get big money from special interests out of our political system. We all know that they buy access and influence through campaign contributions, and benefit from the big payoffs (examples: Wall Street, health care, banking) and, of course, provide a lucrative revolving door to soften the blow when elected officials leave office.

Steps are already being taken by some big names. Starbucks CEO Howard Schultz urged fellow CEO’s and campaign donors this week to boycott campaign contributions until the parties actually do something constructive to fight long term fiscal concerns and the jobs crisis. Former PA Gov. Ed Rendell has said he will support it as well:

We have already gotten a huge response from all over the country about this amendment. Here’s what people have to say:

It’s time to get things done and finally get money out of politics. Our Washington insider Jimmy Williams is now preparing a Constitutional amendment to get big money from special interests out of our political system. We all know that they buy access and influence through campaign contributions, and benefit from the big payoffs (examples: Wall Street, health care, banking) and, of course, provide a lucrative revolving door to soften the blow when elected officials leave office.

It’s time to get things done and finally get money out of politics. Our Washington insider Jimmy Williams is now preparing a Constitutional amendment to get big money from special interests out of our political system. We all know that they buy access and influence through campaign contributions, and benefit from the big payoffs (examples: Wall Street, health care, banking) and, of course, provide a lucrative revolving door to soften the blow when elected officials leave office.Steps are already being taken by some big names. Starbucks CEO Howard Schultz urged fellow CEO’s and campaign donors this week to boycott campaign contributions until the parties actually do something constructive to fight long term fiscal concerns and the jobs crisis. Former PA Gov. Ed Rendell has said he will support it as well:

There are so many legislators who have said to me, gosh, if I could vote in secret, I could vote for your proposal Governor because I know it’s the right thing to do. But I can’t do it. The other side will raise money on it and kill me. And that’s what’s so important — it is so important to get the influence of money out of politics. Because if you get the influence of money out of politics, we will get people who will actually vote their conscience. And I think that’s extraordinarily important. You’re right to say it’s not the lobbyists… but it is the money that perverts the entire process…. I would be interested in Jimmy’s drafting the amendment.

Jimmy is hard at work on our amendment, but we want to hear from you. What do you want to see in this amendment? What else do we do to get money out of politics? Send us a message via this form or email us at MadAsHell@DylanRatigan.com, and we’ll post the best ideas on Monday and Tuesday.We have already gotten a huge response from all over the country about this amendment. Here’s what people have to say:

Robert Wilson: “Fostered by the influence of money at every level of government, compromise suffers. Nothing ever really gets done. Whether problems are social or economic or whether policies require regulation or deregulation, the job of governing our country should be entrusted to those who aren’t tempted by money. The current system is an insult to the Founding Fathers.”

Don: “I can’t believe it took this long for someone to propose a constitutional amendment to limit campaign spending. It took me about 1 micro second after the Supreme Court ruling which allowed unlimited contributions from large corporations to political campaigns to figure that out: if the court interprets the Constitution that way, we just have to change the Constitution. I’m really looking forward to seeing how far this goes.

Gordon: “The corporate manipulation of politics is actually counter to the “free market” concept where the market is free to determine which businesses provide real value to the consumers. A truly “free market” is based on transparency and free from the collusion of lobbying and back room deals.”

Kylee: “I hear many people say that we can’t accomplish things that sound insurmountable, but if we look back on Americas past, we have to say this just isn’t so…. What we have to remember is that freedom isn’t free and if we sit back long enough, sure enough someone will work to take it away from us, and once again we must fight. “

Karen Rose: “Imagine if 100 million people not only signed on to asking for a Constitutional Amendment, but also took a pledge vowing not to vote for ANY national candidate unless they voiced public support for this amendment. Corporations may be people in the eyes of the SCOTUS, but, as of yet, they still cannot vote, WE DO!”

In the meantime, be sure to follow Jimmy on Twitter for the latest on our amendment — let him know you appreciate his hard work!

Gov. Rendell and Dylan had an excellent conversation on the topic on Wednesday. If you missed it, watch the clip here and get caught up:

Ready to be part of real change?

273,603 signatures? We're just getting started! Help us hit our new goal of 500,000 Americans united to Get Money Out!

Why do you want to Get Money Out of Politics?

Add your name to the 273,603 supporters

Or text SIGN to 917-720-6888 to sign the petition.

By adding your name, you show your support for passing a constitutional amendment to Get Money Out of politics. Over a dozen different versions of the amendment have been proposed, click here to learn more about them all or read our version here. We may not all agree on the wording, but we all agree it's time to Get Money Out.

Auction 2012: Energy Lobby Finds Power In Money And Fear

Posted: 01/31/2012 10:46 am

Auction 2012 is a weeklong series in collaboration with "The Dylan Ratigan Show" and United Republic.

When George W. Bush overruled scientists at the Environmental Protection Agency in 2008 and set a new smog standard that was considerably weaker than they had recommended, it was just another example of how closely entwined the interests of the energy sector and the Republican Party had become.

But when President Barack Obama this fall suddenly killed the stronger smog standards championed by his own EPA administrator -- thereby leaving the Bush-era standards unchanged -- it was a clear indication that the energy lobby's influence is powerful enough to intimidate the Democrats as well.

Obama's decision was widely seen as driven by politics, not science or even economics.

Lowering the ozone standard from 75 parts per billion to 60 parts would have prevented 4,000 to 12,000 premature deaths annually, along with 58,000 cases of aggravated asthma and 2.5 million days of missed work or school, according to the EPA. The agency also estimated that tightening the standard could cost as much as $90 billion per year, but that the benefits would total as much as $100 billion per year.

Industry groups contended that millions of jobs would be lost. Environmentalists and progressives argued the new standard would likely have created jobs -- and green jobs at that.

Powerhouse lobbying groups, including the American Petroleum Institute, Business Roundtable and U.S. Chamber of Commerce, led a fierce fight, repeatedly meeting with White House officials to argue against the rule. Industry representatives worked the refs -- then-White House chief of staff Richard Daley and regulatory czar Cass Sunstein -- appealing to their own anti-regulatory leanings.

And behind all that was the implicit -- or perhaps explicit -- threat that if Obama sided against the big money, it would return to haunt him, quite possibly in the form of massive ad purchases in swing states labeling him a job-killer in his reelection year. Especially in the new campaign finance era, there is legally no limit to how much firepower the energy sector could bring to bear.

Of course, those attacks may come anyway.

The energy industry pours hundreds of millions of dollars a year into political contributions and lobbying -- considerably less than the financial, legal or health sectors, but by any other standards, a massive amount.

Oil and gas interests, for instance, spent $145 million on lobbying in 2011, with electric utilities right behind at $144 million, according to data collected by the Center for Responsive Politics. In a telling sign of clout, more than half of the 2,177 registered lobbyists working on the energy sector's behalf were formerly government officials.

Unlike Wall Street, which historically has spread its campaign contributions around to both parties, the oil and gas industry leans heavily toward Republicans, especially over the last 15 years. At the same time, the GOP's anti-tax policies, anti-regulatory campaigns and pro-drilling rhetoric have become increasingly indistinguishable from the American Petroleum Institute's agenda.

In the early 1990s, the oil and gas industry's campaign spending favored Republicans over Democrats, but not by that much. For every $1 the industry gave to Democrats, it gave Republicans $1.78. But starting in the 1996 election cycle, that changed dramatically. By the 2010 election cycle, for every $1 the industry gave Democrats, it gave Republicans about $3.43. And so far in the 2012 campaign cycle, the tilt toward the GOP is more than 7 to 1, with individuals and companies associated with oil and gas contributing almost $12 million to Republicans and $1.6 million to Democrats.

In 1994, six of the top 20 recipients of oil and gas money were Democrats. Today, every single one is a Republican.

The like-mindedness linking the industry and the GOP is best illustrated these days by the party's unprecedented congressional assault against environmental regulations. Last year, with Republicans back in control of the House, there were at least 159 votes on anti-environmental protection measures on the House floor alone, including 83 targeting the EPA, according to a list compiled by Democrats on the House Energy and Commerce Committee.

That's because the energy lobby never rests, said Tyson Slocum, director of the energy program for the consumer watchdog group Public Citizen.

"You're not satisfied with having a D.C. operation just to make sure that government doesn't do you any harm," he said, explaining industry thinking. "The goal is not to maintain the status quo. What you really want to do is to try to gain advantage."

For the fossil fuel industry, that can also mean "trying to demonize alternatives to your business model," including alternative energy sources and greater energy efficiency, Slocum said.

And often the battle has come down to tax breaks.

The energy industry won its most recent major tax break in 2004, after the World Trade Organization had repeatedly declared U.S. export tax incentives illegal. Congress set out to replace them with an income tax deduction for domestic manufacturing -- and somehow oil and natural gas production, despite having been explicitly precluded from the earlier incentives, was covered by the new deduction. That windfall now adds about $1 billion a year to the industry's bottom line.

Federal tax breaks for oil and gas total somewhere between $4 billion and $9 billion a year, even as the industry revels in record profits, undaunted by the financial crisis that has crippled so much of the American economy.

Obama's line at the 2012 State of the Union address -- "We've subsidized oil companies for a century. That's long enough." -- was greeted by applause. But if history is any guide, his proposal will come to naught.

Perhaps most important of all, the energy industry's political power has allowed it to crush -- and now make politically unthinkable -- any effort to assess the external costs of greenhouse gases created in the production and consumption of fossil fuels.

Just as one point of reference, a 2009 report from the National Research Council tried to estimate the costs of air pollution and other harms that are not reflected in the market price of fossil fuels. The report pegged the price of the damage from fossil fuel production and consumption at $120 billion in the U.S. in 2005 alone -- and that notably did not include the cost of climate change, harm to ecosystems, effects of some toxic air pollutants and risks to national security, all of which the report was unable to quantify.

Looking at power plants' burning of coal, the report found that damages from sulfur dioxide, nitrogen oxides and particulate matter averaged about 3.2 cents for every kilowatt-hour of energy produced. It estimated climate-related monetary damages at 0.1 cents to 10 cents per kwh, depending on assumptions. By contrast, coal costs 7 to 14 cents per kwh.

Yet any kind of carbon tax or fee is politically impossible right now, said Kyle Ash, senior legislative representative for Greenpeace. It's not so much an issue of dogma. "There are a lot fewer climate deniers than people think," he said.

It's a matter of money. "There's a lot of good data on which politicians are taking how much money from fossil fuel industries, and you can see clear connections," Ash said, pointing to a recent Greenpeace report titled "Polluting Democracy." "I think it's about who's paying for their campaigns," he said.

The clearest evidence, he said, comes in the otherwise unresolvable contradiction between what politicians say and what they do.

"The contradiction is that they're also really opposed to federal outlays, and they want to cut taxes," Ash said. "But they're fighting against the removal of fossil fuel subsidies."

The Auction 2012 series explores the ways industries influence policymaking in five areas: banking, energy, health care, trade and education. Read Dylan Ratigan's blog post introducing the series and his blog post on energy.

Follow this diagram of energy-industry power from Dylan Ratigan's book "Greedy Bastards":

Auction 2012 is a weeklong series in collaboration with "The Dylan Ratigan Show" and United Republic.

When George W. Bush overruled scientists at the Environmental Protection Agency in 2008 and set a new smog standard that was considerably weaker than they had recommended, it was just another example of how closely entwined the interests of the energy sector and the Republican Party had become.

But when President Barack Obama this fall suddenly killed the stronger smog standards championed by his own EPA administrator -- thereby leaving the Bush-era standards unchanged -- it was a clear indication that the energy lobby's influence is powerful enough to intimidate the Democrats as well.

Obama's decision was widely seen as driven by politics, not science or even economics.

Lowering the ozone standard from 75 parts per billion to 60 parts would have prevented 4,000 to 12,000 premature deaths annually, along with 58,000 cases of aggravated asthma and 2.5 million days of missed work or school, according to the EPA. The agency also estimated that tightening the standard could cost as much as $90 billion per year, but that the benefits would total as much as $100 billion per year.

Industry groups contended that millions of jobs would be lost. Environmentalists and progressives argued the new standard would likely have created jobs -- and green jobs at that.

Powerhouse lobbying groups, including the American Petroleum Institute, Business Roundtable and U.S. Chamber of Commerce, led a fierce fight, repeatedly meeting with White House officials to argue against the rule. Industry representatives worked the refs -- then-White House chief of staff Richard Daley and regulatory czar Cass Sunstein -- appealing to their own anti-regulatory leanings.

And behind all that was the implicit -- or perhaps explicit -- threat that if Obama sided against the big money, it would return to haunt him, quite possibly in the form of massive ad purchases in swing states labeling him a job-killer in his reelection year. Especially in the new campaign finance era, there is legally no limit to how much firepower the energy sector could bring to bear.

Of course, those attacks may come anyway.

The energy industry pours hundreds of millions of dollars a year into political contributions and lobbying -- considerably less than the financial, legal or health sectors, but by any other standards, a massive amount.

Oil and gas interests, for instance, spent $145 million on lobbying in 2011, with electric utilities right behind at $144 million, according to data collected by the Center for Responsive Politics. In a telling sign of clout, more than half of the 2,177 registered lobbyists working on the energy sector's behalf were formerly government officials.

Unlike Wall Street, which historically has spread its campaign contributions around to both parties, the oil and gas industry leans heavily toward Republicans, especially over the last 15 years. At the same time, the GOP's anti-tax policies, anti-regulatory campaigns and pro-drilling rhetoric have become increasingly indistinguishable from the American Petroleum Institute's agenda.

In the early 1990s, the oil and gas industry's campaign spending favored Republicans over Democrats, but not by that much. For every $1 the industry gave to Democrats, it gave Republicans $1.78. But starting in the 1996 election cycle, that changed dramatically. By the 2010 election cycle, for every $1 the industry gave Democrats, it gave Republicans about $3.43. And so far in the 2012 campaign cycle, the tilt toward the GOP is more than 7 to 1, with individuals and companies associated with oil and gas contributing almost $12 million to Republicans and $1.6 million to Democrats.

In 1994, six of the top 20 recipients of oil and gas money were Democrats. Today, every single one is a Republican.

The like-mindedness linking the industry and the GOP is best illustrated these days by the party's unprecedented congressional assault against environmental regulations. Last year, with Republicans back in control of the House, there were at least 159 votes on anti-environmental protection measures on the House floor alone, including 83 targeting the EPA, according to a list compiled by Democrats on the House Energy and Commerce Committee.

That's because the energy lobby never rests, said Tyson Slocum, director of the energy program for the consumer watchdog group Public Citizen.

"You're not satisfied with having a D.C. operation just to make sure that government doesn't do you any harm," he said, explaining industry thinking. "The goal is not to maintain the status quo. What you really want to do is to try to gain advantage."

For the fossil fuel industry, that can also mean "trying to demonize alternatives to your business model," including alternative energy sources and greater energy efficiency, Slocum said.

And often the battle has come down to tax breaks.

The energy industry won its most recent major tax break in 2004, after the World Trade Organization had repeatedly declared U.S. export tax incentives illegal. Congress set out to replace them with an income tax deduction for domestic manufacturing -- and somehow oil and natural gas production, despite having been explicitly precluded from the earlier incentives, was covered by the new deduction. That windfall now adds about $1 billion a year to the industry's bottom line.

Federal tax breaks for oil and gas total somewhere between $4 billion and $9 billion a year, even as the industry revels in record profits, undaunted by the financial crisis that has crippled so much of the American economy.

Obama's line at the 2012 State of the Union address -- "We've subsidized oil companies for a century. That's long enough." -- was greeted by applause. But if history is any guide, his proposal will come to naught.

Perhaps most important of all, the energy industry's political power has allowed it to crush -- and now make politically unthinkable -- any effort to assess the external costs of greenhouse gases created in the production and consumption of fossil fuels.

Just as one point of reference, a 2009 report from the National Research Council tried to estimate the costs of air pollution and other harms that are not reflected in the market price of fossil fuels. The report pegged the price of the damage from fossil fuel production and consumption at $120 billion in the U.S. in 2005 alone -- and that notably did not include the cost of climate change, harm to ecosystems, effects of some toxic air pollutants and risks to national security, all of which the report was unable to quantify.

Looking at power plants' burning of coal, the report found that damages from sulfur dioxide, nitrogen oxides and particulate matter averaged about 3.2 cents for every kilowatt-hour of energy produced. It estimated climate-related monetary damages at 0.1 cents to 10 cents per kwh, depending on assumptions. By contrast, coal costs 7 to 14 cents per kwh.

Yet any kind of carbon tax or fee is politically impossible right now, said Kyle Ash, senior legislative representative for Greenpeace. It's not so much an issue of dogma. "There are a lot fewer climate deniers than people think," he said.

It's a matter of money. "There's a lot of good data on which politicians are taking how much money from fossil fuel industries, and you can see clear connections," Ash said, pointing to a recent Greenpeace report titled "Polluting Democracy." "I think it's about who's paying for their campaigns," he said.

The clearest evidence, he said, comes in the otherwise unresolvable contradiction between what politicians say and what they do.

"The contradiction is that they're also really opposed to federal outlays, and they want to cut taxes," Ash said. "But they're fighting against the removal of fossil fuel subsidies."

The Auction 2012 series explores the ways industries influence policymaking in five areas: banking, energy, health care, trade and education. Read Dylan Ratigan's blog post introducing the series and his blog post on energy.

Follow this diagram of energy-industry power from Dylan Ratigan's book "Greedy Bastards":

Auction 2012: Banking

Auction 2012 is a weeklong series in partnership with The Huffington Post and United Republic. Here’s Dylan’s interview with Paul Blumenthal of The Huffington Post kicking off today’s Auction 2012 series.

First Posted: 01/30/2012 11:25 am Updated: 01/30/2012 7:50 pm

Auction 2012 is a weeklong series in collaboration with "The Dylan Ratigan Show" and United Republic.

When Washington puts policy on the auction block, bankers are consistently the highest bidders.

The industry's most striking victory has been the watering down of post-financial crisis reforms, to the point that banks are now bigger than ever and the bonuses keep flowing. But Wall Street's campaign spending and lobbying power is so intimidating that banks have repeatedly stuck the public with the tab for their losses and no one in Washington stops them.

Why hasn't the government done something about outrageous ATM fees? Or credit card interest rates up to 30 percent? Bankers' clout is such that common-sense pro-consumer legislation is presumptively dead on arrival at Capitol Hill if it threatens banks' revenue streams.

An epic recent battle between consumers and Wall Street was fought over a congressional proposal to give bankruptcy judges the legal authority to modify principal balances on mortgages in a way that is fair to both parties. Known as "cramdown," it would have allowed more than a million ordinary Americans to keep their homes. But because it would have leveled the playing field between banks and debtors -- and would have forced banks to officially recognize losses they don't want to acknowledge -- the financial services industry fought cramdown with everything it had.

In May 2009, toward the end of his futile battle for cramdown, Sen. Dick Durbin (D-Ill.) famously told a radio host, "And the banks -- hard to believe in a time when we're facing a banking crisis that many of the banks created -- are still the most powerful lobby on Capitol Hill. And they frankly own the place."

Consider the numbers: The finance, insurance and real estate (FIRE) sector combined to spend $6.8 billion on federal lobbying and campaign contributions from 1998 through 2011, according to the Center for Responsive Politics' examination of public records. That's $1 billion more than any other sector spent on Washington.

A recent study by the Sunlight Foundation found that individuals within the FIRE sector were head and shoulders above those in other industries in making large campaign contributions.

Big banks' undisclosed contributions also underwrite powerful trade groups like the American Bankers Association, the U.S. Chamber of Commerce and the Business Roundtable.

And more than half of the lobbyists working for the FIRE sector are ex-government officials -- in many cases, onetime lawmakers and staffers who helped write laws that deregulated the industry. When in need, the banks can call on the firepower of former Senate leaders like Phil Gramm, Trent Lott and Bob Dole and former House leaders like Dennis Hastert, Dick Armey and Dick Gephardt.

CONSUMERS LOSE

Despite widespread public support, an attempt by Durbin and firebrand Sen. Bernie Sanders (I-Vt.) to cap interest rates on credit cards in 2009 was doomed by industry opposition.

Starting in February of that year, reports emerged that millions of cardholders were being told their interest rates would go up -- in some cases to 30 percent -- if they missed even one payment. Then-Sen. Chris Dodd (D-Conn.) concluded that lenders were "gouging" customers to make up for losses. Readers told The Huffington Post their stories of woe.

By April, the backlash on Capitol Hill led Sanders to propose an interest rate cap of 15 percent. "We both want to reinstitute the notion of a usury law for the United States," Durbin told HuffPost's Ryan Grim.

The New York Times in May declared the bill a shoo-in. "Lawmakers say the industry's time has come," wrote reporter Carl Hulse. And President Barack Obama's rousing May 14 town hall meeting excoriating the credit card companies played well in Albuquerque, N.M.

But that very same day, the Sanders amendment died in the Senate with only 33 votes. It needed 60.

The Times somberly explained, "The banking industry, which had some heavyweight representatives monitoring the vote, warned that an interest rate limit could cause a sour reaction in the financial markets."

A year later, in May 2010, Sen. Sheldon Whitehouse (D-R.I.) introduced an amendment that would have allowed individual states to cap credit card interest rates. The goal was to close a federal loophole that permitted credit card companies to headquarter in states with looser rules, like South Dakota and Delaware, and charge whatever they wanted to charge nationwide.

That proposal was defeated by a 60-35 vote.

Also in May 2010, Sen. Tom Harkin (D-Iowa) launched a campaign to cap ATM transaction fees. Noting that ATM fees average $2.50 and can run as high as $5 -- while the real cost of processing a transaction is about 35 cents -- Harkin proposed to cap fees at 50 cents. "The burden falls more heavily on low-income and moderate-income people," he noted. "That is grossly unfair."

Banks opposed the idea, arguing that capping fees would just lead to fewer cash machines, including those owned by banks.

Harkin couldn't even get a floor vote. Two weeks after he first put forth his proposed amendment to the Dodd-Frank financial reform legislation, he took to the Senate floor and asked to be heard. It was his own party chief, Senate Majority Leader Harry Reid (D-Nev.), who denied his request -- because the Republicans hadn't agreed to it.

"What kind of games are being played around here?" Harkin asked the Senate chamber. "I've had this amendment pending ever since the beginning. And I have not been allowed to bring it up."

BANKS GET THEIR WAY

So what explains the banks' ability time and again to kill bills that threaten their bottom line?

Georgetown Law School professor Adam Levitin, who closely followed the cramdown debate, observes that banks push all the levers in Washington.

"They make an awful lot of campaign contributions," said Levitin. That "would be number one. They aren't making those just out of the goodness of their heart. They're hoping that it gets them some influence. It certainly gets them an audience at the very least."

Then there are the "army of lobbyists," Levitin said. "I think it's hard for your average citizen to understand the intensity of lobbying of both people on the Hill and in government agencies."

Alongside the professional lobbyists come actual bankers -- but not necessarily the Wall Street crowd, even though they have the most at stake. The financial industry brings in local bankers, often from the lawmakers' own districts.

"The banks that really had the big portfolios were not the face of the opposition," recalled Rep. Brad Miller (D-N.C.), who championed cramdown on the House side. "The [American Bankers Association] always sends up the owner of some three-branch community bank instead."

"The community banks and credit unions have outsized political influence relative to their role in the economy," Levitin explained. Members of Congress will always make time for them.

In March 2009, after the House Democratic leadership made a "herculean effort," Miller said, the cramdown measure passed the lower chamber 234-191.

But in the Senate, thanks to ferocious bank lobbying -- and a puzzling lack of support, if not outright opposition, from the Obama administration -- it was defeated by a wide margin, with the bill falling 15 votes short of the 60 needed to cut off debate and move to a final vote.

After the vote, Durbin despaired to HuffPost reporter Grim, "Frankly, I can't match what the bankers are doing in terms of lobbying."

Meanwhile, David Kittle, chairman of the Mortgage Bankers Association, gleefully told the American News Project, "We led the way on this, and we are clearly responsible for defeating this for the third time in the last year."

Durbin told Grim he still held out some hope for the future: "When the voters speak, some elected officials listen. So I hope that, if we fail on mortgage foreclosure and we fail on credit card reform, I hope that people in this country will stand up and say to Congress, 'You've got the wrong friends.'"

The Auction 2012 series explores the ways industries influence policymaking in five areas: banking, energy, health care, trade and education. Read Dylan Ratigan's blog post introducing the series and his blog post on banking.

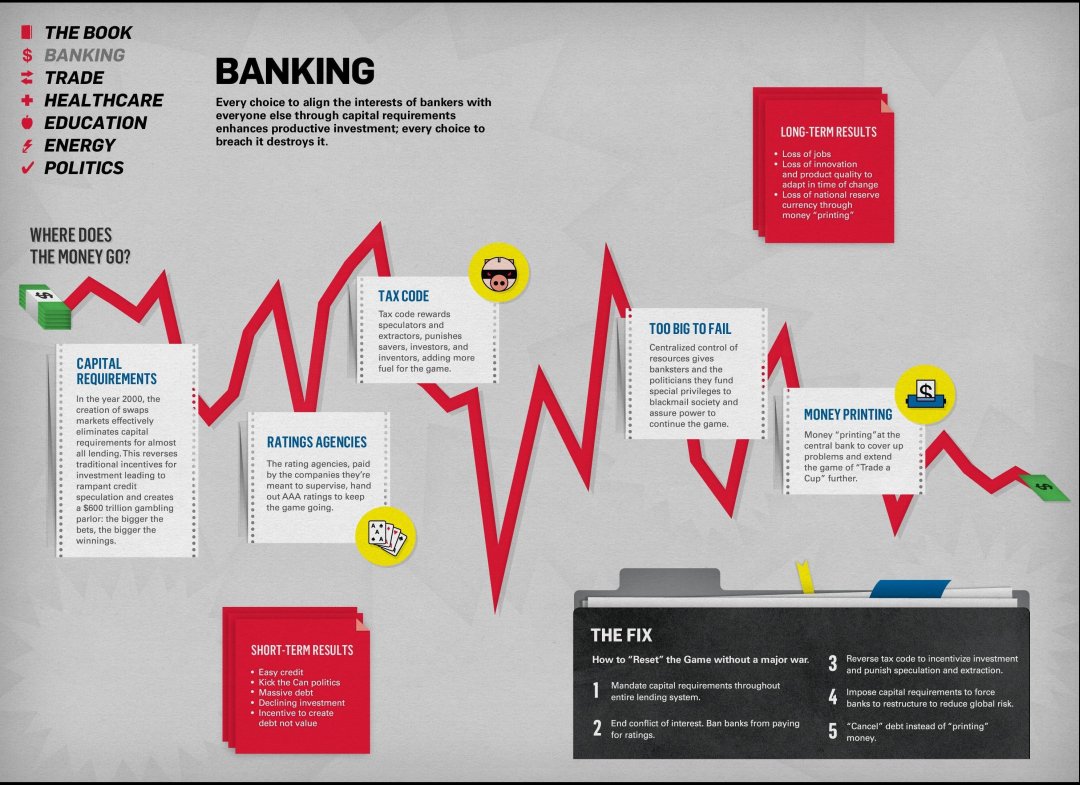

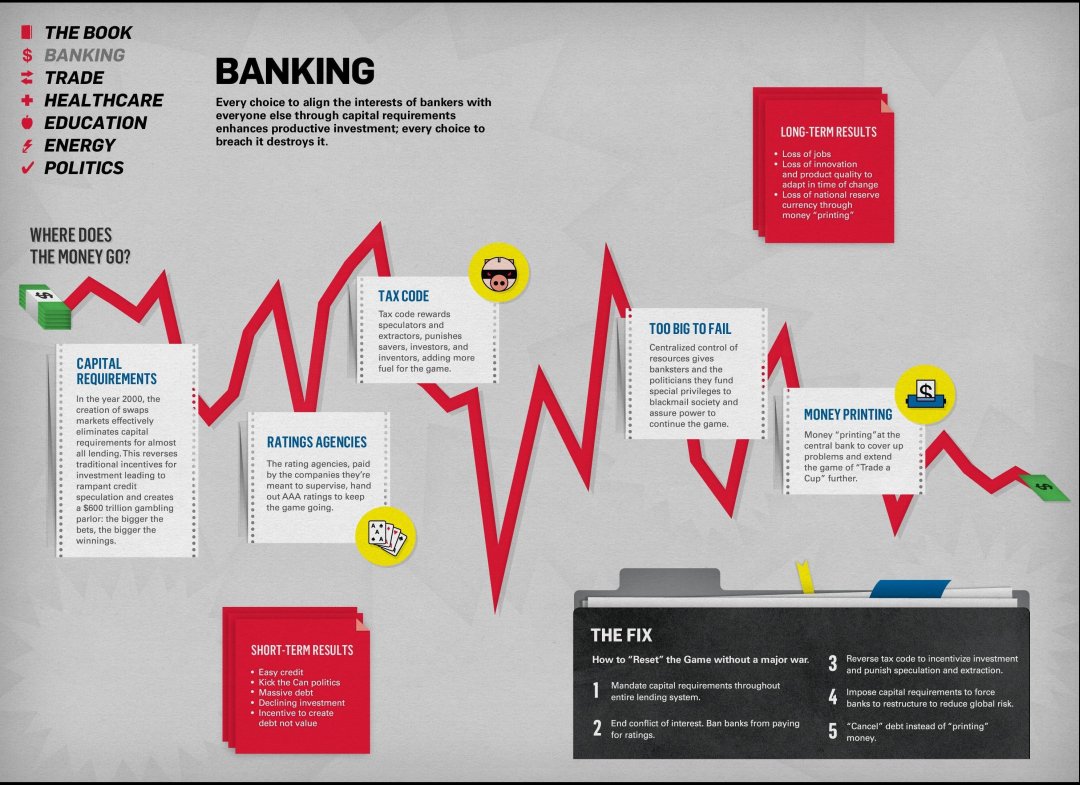

Follow this diagram of how banks became gamblers from Dylan Ratigan's book "Greedy Bastards":

Auction 2012 is a weeklong series in collaboration with "The Dylan Ratigan Show" and United Republic.

When Washington puts policy on the auction block, bankers are consistently the highest bidders.

The industry's most striking victory has been the watering down of post-financial crisis reforms, to the point that banks are now bigger than ever and the bonuses keep flowing. But Wall Street's campaign spending and lobbying power is so intimidating that banks have repeatedly stuck the public with the tab for their losses and no one in Washington stops them.

Why hasn't the government done something about outrageous ATM fees? Or credit card interest rates up to 30 percent? Bankers' clout is such that common-sense pro-consumer legislation is presumptively dead on arrival at Capitol Hill if it threatens banks' revenue streams.

An epic recent battle between consumers and Wall Street was fought over a congressional proposal to give bankruptcy judges the legal authority to modify principal balances on mortgages in a way that is fair to both parties. Known as "cramdown," it would have allowed more than a million ordinary Americans to keep their homes. But because it would have leveled the playing field between banks and debtors -- and would have forced banks to officially recognize losses they don't want to acknowledge -- the financial services industry fought cramdown with everything it had.

In May 2009, toward the end of his futile battle for cramdown, Sen. Dick Durbin (D-Ill.) famously told a radio host, "And the banks -- hard to believe in a time when we're facing a banking crisis that many of the banks created -- are still the most powerful lobby on Capitol Hill. And they frankly own the place."

Consider the numbers: The finance, insurance and real estate (FIRE) sector combined to spend $6.8 billion on federal lobbying and campaign contributions from 1998 through 2011, according to the Center for Responsive Politics' examination of public records. That's $1 billion more than any other sector spent on Washington.

A recent study by the Sunlight Foundation found that individuals within the FIRE sector were head and shoulders above those in other industries in making large campaign contributions.

Big banks' undisclosed contributions also underwrite powerful trade groups like the American Bankers Association, the U.S. Chamber of Commerce and the Business Roundtable.

And more than half of the lobbyists working for the FIRE sector are ex-government officials -- in many cases, onetime lawmakers and staffers who helped write laws that deregulated the industry. When in need, the banks can call on the firepower of former Senate leaders like Phil Gramm, Trent Lott and Bob Dole and former House leaders like Dennis Hastert, Dick Armey and Dick Gephardt.

CONSUMERS LOSE

Despite widespread public support, an attempt by Durbin and firebrand Sen. Bernie Sanders (I-Vt.) to cap interest rates on credit cards in 2009 was doomed by industry opposition.

Starting in February of that year, reports emerged that millions of cardholders were being told their interest rates would go up -- in some cases to 30 percent -- if they missed even one payment. Then-Sen. Chris Dodd (D-Conn.) concluded that lenders were "gouging" customers to make up for losses. Readers told The Huffington Post their stories of woe.

By April, the backlash on Capitol Hill led Sanders to propose an interest rate cap of 15 percent. "We both want to reinstitute the notion of a usury law for the United States," Durbin told HuffPost's Ryan Grim.

The New York Times in May declared the bill a shoo-in. "Lawmakers say the industry's time has come," wrote reporter Carl Hulse. And President Barack Obama's rousing May 14 town hall meeting excoriating the credit card companies played well in Albuquerque, N.M.

But that very same day, the Sanders amendment died in the Senate with only 33 votes. It needed 60.

The Times somberly explained, "The banking industry, which had some heavyweight representatives monitoring the vote, warned that an interest rate limit could cause a sour reaction in the financial markets."

A year later, in May 2010, Sen. Sheldon Whitehouse (D-R.I.) introduced an amendment that would have allowed individual states to cap credit card interest rates. The goal was to close a federal loophole that permitted credit card companies to headquarter in states with looser rules, like South Dakota and Delaware, and charge whatever they wanted to charge nationwide.

That proposal was defeated by a 60-35 vote.

Also in May 2010, Sen. Tom Harkin (D-Iowa) launched a campaign to cap ATM transaction fees. Noting that ATM fees average $2.50 and can run as high as $5 -- while the real cost of processing a transaction is about 35 cents -- Harkin proposed to cap fees at 50 cents. "The burden falls more heavily on low-income and moderate-income people," he noted. "That is grossly unfair."

Banks opposed the idea, arguing that capping fees would just lead to fewer cash machines, including those owned by banks.

Harkin couldn't even get a floor vote. Two weeks after he first put forth his proposed amendment to the Dodd-Frank financial reform legislation, he took to the Senate floor and asked to be heard. It was his own party chief, Senate Majority Leader Harry Reid (D-Nev.), who denied his request -- because the Republicans hadn't agreed to it.

"What kind of games are being played around here?" Harkin asked the Senate chamber. "I've had this amendment pending ever since the beginning. And I have not been allowed to bring it up."

BANKS GET THEIR WAY

So what explains the banks' ability time and again to kill bills that threaten their bottom line?

Georgetown Law School professor Adam Levitin, who closely followed the cramdown debate, observes that banks push all the levers in Washington.

"They make an awful lot of campaign contributions," said Levitin. That "would be number one. They aren't making those just out of the goodness of their heart. They're hoping that it gets them some influence. It certainly gets them an audience at the very least."

Then there are the "army of lobbyists," Levitin said. "I think it's hard for your average citizen to understand the intensity of lobbying of both people on the Hill and in government agencies."

Alongside the professional lobbyists come actual bankers -- but not necessarily the Wall Street crowd, even though they have the most at stake. The financial industry brings in local bankers, often from the lawmakers' own districts.

"The banks that really had the big portfolios were not the face of the opposition," recalled Rep. Brad Miller (D-N.C.), who championed cramdown on the House side. "The [American Bankers Association] always sends up the owner of some three-branch community bank instead."

"The community banks and credit unions have outsized political influence relative to their role in the economy," Levitin explained. Members of Congress will always make time for them.

In March 2009, after the House Democratic leadership made a "herculean effort," Miller said, the cramdown measure passed the lower chamber 234-191.

But in the Senate, thanks to ferocious bank lobbying -- and a puzzling lack of support, if not outright opposition, from the Obama administration -- it was defeated by a wide margin, with the bill falling 15 votes short of the 60 needed to cut off debate and move to a final vote.

After the vote, Durbin despaired to HuffPost reporter Grim, "Frankly, I can't match what the bankers are doing in terms of lobbying."

Meanwhile, David Kittle, chairman of the Mortgage Bankers Association, gleefully told the American News Project, "We led the way on this, and we are clearly responsible for defeating this for the third time in the last year."

Durbin told Grim he still held out some hope for the future: "When the voters speak, some elected officials listen. So I hope that, if we fail on mortgage foreclosure and we fail on credit card reform, I hope that people in this country will stand up and say to Congress, 'You've got the wrong friends.'"

The Auction 2012 series explores the ways industries influence policymaking in five areas: banking, energy, health care, trade and education. Read Dylan Ratigan's blog post introducing the series and his blog post on banking.

Follow this diagram of how banks became gamblers from Dylan Ratigan's book "Greedy Bastards":

Subscribe to:

Comments (Atom)